What Buyer’s Market?

We’ve all heard news reports that Seattle housing market is in the dumps, with a glut of inventory and falling prices. And, there’s truth to that…to a degree.

Unfortunately, whenever those housing report are mentioned, they cover a rather large geographic area. Generally, most of the reports include stats from the Seattle Metropolitan Statistical Area…meaning King, Pierce and Snohomish Counties.

The problem with using such an expansive geographic area is that real estate, namely housing trends, are localized. The housing market in Seattle is quite different from Everett, or Bellevue, or Tacoma or Puyallup. And, even within Seattle, it can vary widely by neighborhood, pricing tiers and property type (single family houses vs. condos).

When we look specifically at Seattle’s housing market – the results are striking. The overall market (SFH & condos) is in a balanced market climate based on the absorption rate, and for single family homes, it’s a borderline seller’s market. Absorption rate (inventory supply rate), is the rate at which the inventory will sell out at the current rate of demand (sales). It is used as an indicator to gauge the market environment.

| 1-3 months of supply: | Seller’s Market | |

| 4-6 months of supply: | Balanced Market | |

| 7+ months of supply: | Buyer’s Market |

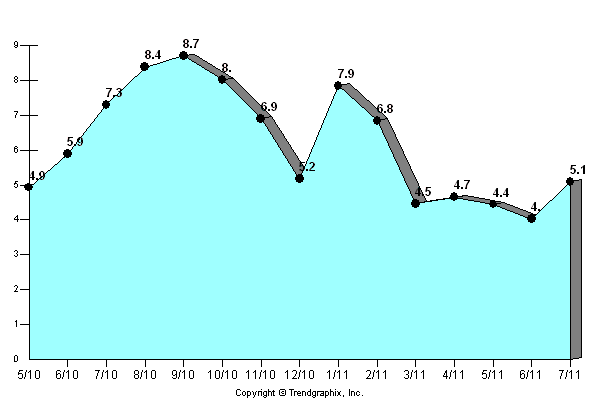

Seattle Absorption Rate (SFH & condos), expressed in months:

Based on the current rate of closed sales, Seattle has a 5.1 month inventory supply rate. Roughly, 20% of the inventory is being absorbed every month. As the graph indicates, Seattle has been in a balanced real estate market for most of 2011.

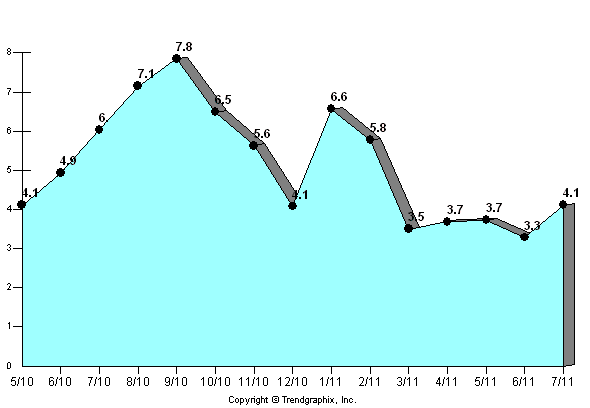

Seattle Single Family Absorption Rate, expressed in months:

Seattle’s single family properties have a 4.1 month inventory supply rate. Over the past several months, the market has been indicative of a balanced to seller’s market environment. Approximately 24% of the inventory is being absorbed every month.

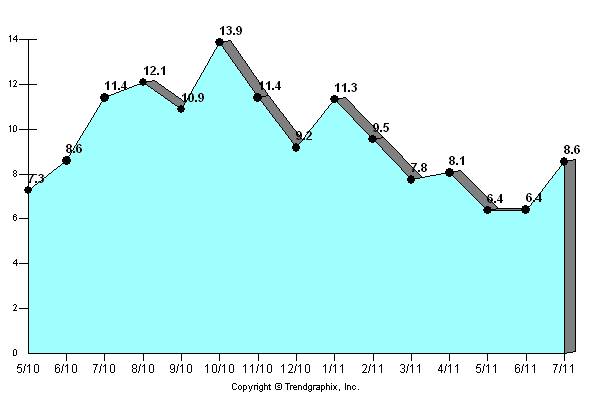

Seattle Condo Absorption Rate, expressed in months:

Seattle’s condo market is another story. The absorption rate rose to 8.6 months of supply based on the number of July closings. For the most part, condos have exhibited a buyer’s market climate with about 12% of the inventory being absorbed. It’ll take the condo market a bit longer to recover. Fortunately, there won’t be any new units delivered for at least 4 years, which will allow the current inventory to dissipate over time.

So, what’s the story behind Seattle’ relatively normal real estate market?

There are several factors that are attributable to our local housing market, such as:

- Employment. Buoyed by the tech sector educated, well-paid professionals are moving into Seattle with Amazon, Google, Microsoft and Facebook hiring thousands. The Gates Foundation is also expanding.

- Cheap money. Recently, mortgage interest rates clocked in a 50-year historic low, making it incredibly inexpensive to borrow money for home purchases. This past week, even FHA mortgage rates were down to 4.25% for a 30-year fixed.

- Affordable home prices. The economic slow down, uncertainty, the bursted housing bubble and distressed home sales have deflated housing prices in Seattle over the past several years. While that may be a heartbreak for sellers, it’s been a boon for buyers, particularly when combined with low mortgage rates.

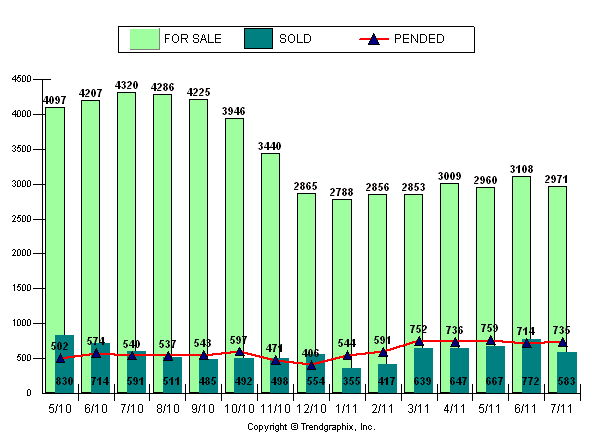

- Shrinking inventory. Geographically, Seattle is confined by water; there isn’t a lot of available land to build massive developments like you’d find on the Eastside or South King County. When it comes to single family homes, Seattle can’t be over built. Additionally, loan modifications and government intervention have slowed the rate of foreclosures, cutting back on on the number of short sale and bank-owned properties. As such, Seattle’s available inventory is down 31% from a year ago (see chart below).

Data source: TrendGraphix